Major UK companies have been victims of a cyberattack recently, which emphasizes the importance of cyber insurance but also heightens complications around coverage for state-led attacks.

British Airways, Boots, and the BBC all had sensitive data on their workers breached, while Manchester University has also been hacked in recent attacks.

The increasing number of high-profile cyberattacks will drive interest in companies to take insurance to safeguard against extensive losses, says GlobalData.

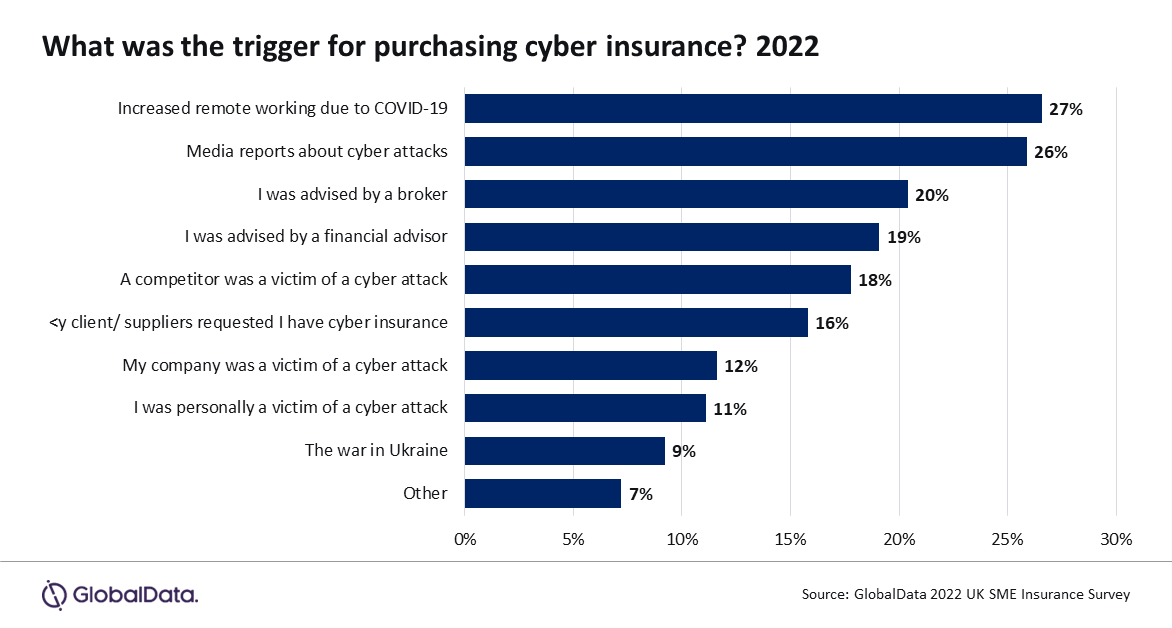

GlobalData’s 2022 UK SME Insurance Survey found that 12.1% of businesses in the UK had a cyber insurance policy in 2022. This is so low due to the large proportion of sole traders within the SME category, as the proportion rises to 52.6% among medium-sized businesses (50–249 employees) alone. This story is likely to increase cyber penetration, as 25.9% of SMEs who held cyber insurance in 2022 purchased it because of media reports about cyberattacks.

Ben Carey-Evans, Senior Insurance Analyst at GlobalData, comments: “The Financial Times said the recent attack was by a Russian-speaking criminal gang, which could raise concern about it being a state-sponsored attack. This could lead to more calls for insurers to exclude such attacks from traditional cyber cover due to the increased risk from geopolitical events. Earlier this year, Lloyds of London advised insurers to exclude nation-led attacks from coverage as a way of controlling the level of risk they are exposing themselves to, and this latest attack is likely to increase calls for that further.”

The Russia-Ukraine war has raised the cyber threat posed to Western businesses, and this makes the risk taken on by insurers even higher. Our SME survey found that 9.2% of businesses who held cyber insurance in 2022 purchased it because of the war in Ukraine.

Carey-Evans concludes: “Cyber insurance is already an expensive product, with the level of risk increasing year on year, and with the ongoing cost-of-living crisis, there is little room for insurers to keep sharply increasing premiums for businesses.”

*GlobalData’s UK SME Insurance Survey was conducted in Q2 and Q3 2022 and had 2,000 respondents.